Unknown Facts About Amur Capital Management Corporation

Unknown Facts About Amur Capital Management Corporation

Blog Article

Indicators on Amur Capital Management Corporation You Should Know

Table of ContentsAmur Capital Management Corporation Things To Know Before You BuyThe Facts About Amur Capital Management Corporation UncoveredSome Known Facts About Amur Capital Management Corporation.The Best Strategy To Use For Amur Capital Management CorporationAmur Capital Management Corporation Can Be Fun For EveryoneThe Basic Principles Of Amur Capital Management Corporation 5 Simple Techniques For Amur Capital Management Corporation

A low P/E ratio might suggest that a firm is underestimated, or that financiers anticipate the firm to face a lot more hard times ahead. Capitalists can make use of the ordinary P/E proportion of other companies in the same industry to develop a baseline.

A Biased View of Amur Capital Management Corporation

The standard in the vehicle and vehicle industry is just 15. A supply's P/E proportion is very easy to find on most economic coverage web sites. This number shows the volatility of a supply in comparison to the marketplace in its entirety. A safety and security with a beta of 1 will certainly show volatility that corresponds that of the market.

A supply with a beta of over 1 is theoretically extra unpredictable than the marketplace. A safety and security with a beta of 1.3 is 30% more volatile than the market. If the S&P 500 rises 5%, a supply with a beta of 1. https://sketchfab.com/amurcapitalmc.3 can be anticipated to climb by 8%

The Main Principles Of Amur Capital Management Corporation

EPS is a buck figure standing for the section of a business's profits, after tax obligations and recommended supply returns, that is assigned to each share of ordinary shares. Investors can use this number to assess just how well a company can provide value to investors. A greater EPS begets greater share rates.

If a business on a regular basis fails to provide on incomes forecasts, a capitalist might wish to reevaluate purchasing the supply - exempt market dealer. The calculation is basic. If a business has a take-home pay of $40 million and pays $4 million in dividends, then the staying amount of $36 million is divided by the number of shares superior

The Greatest Guide To Amur Capital Management Corporation

Financiers frequently get interested in a supply after reading headlines concerning its extraordinary performance. An appearance at the fad in prices over the previous 52 weeks at the least is needed to get a sense of where a stock's rate might go following.

Allow's take a look at what these terms indicate, exactly how they differ and which one is best for the typical financier. Technical experts comb through enormous volumes of data in an effort to anticipate the direction of supply costs. The data consists mostly of previous pricing info and trading quantity. Essential evaluation fits the demands of a lot of financiers and has the benefit of making great sense in the real life.

They believe costs comply with a pattern, and if they can figure out the pattern they can take advantage of it with well-timed trades. In recent years, modern technology has actually enabled more financiers to exercise this style of investing due to the fact that the devices and the information are extra obtainable than ever before. Fundamental analysts consider the intrinsic value of a stock.

Amur Capital Management Corporation Fundamentals Explained

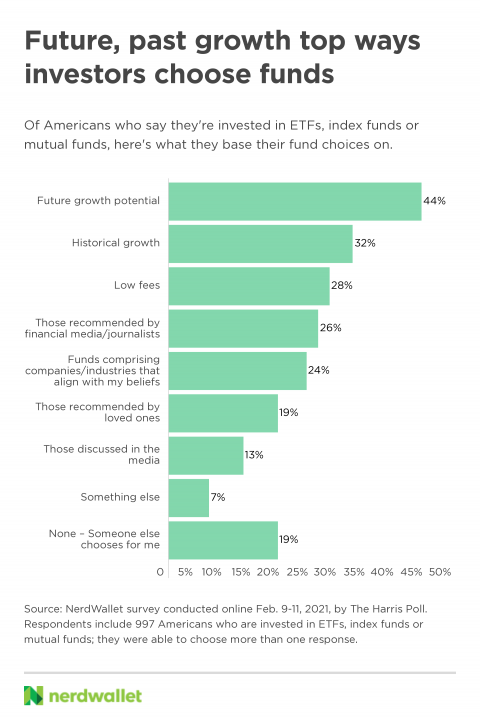

Technical analysis is best fit to a person who has the time and convenience level with information to put limitless numbers to use. Over a duration of 20 years, yearly fees of 0.50% on a $100,000 investment will certainly minimize the portfolio's worth by $10,000. Over the very same period, a 1% cost will certainly lower the very same portfolio by $30,000.

The pattern is with you. Lots of mutual fund business and on-line brokers are lowering their costs in order to complete for customers. Capitalize on the trend and search for the most affordable expense.

See This Report on Amur Capital Management Corporation

Closeness to amenities, eco-friendly space, panoramas, and the community's condition element prominently into home evaluations. Nearness to markets, storage facilities, transport centers, highways, and tax-exempt locations play a vital duty in industrial residential or commercial property valuations. A key when considering home area is the mid-to-long-term view concerning just how the location is anticipated to advance over the financial investment period.

10 Easy Facts About Amur Capital Management Corporation Explained

Thoroughly review the possession and desired usage of the instant locations where you prepare to spend. One means to collect details regarding the prospects of the location of the home you are thinking about is to call the town hall or other public firms visit the site accountable of zoning and urban preparation.

This uses routine earnings and long-lasting value recognition. This is generally for quick, little to medium profitthe normal home is under construction and sold at a revenue on conclusion.

Report this page